What is the Junior ISA allowance?

Understanding the rules and allowances for Junior ISAs is important for parents and guardians planning long-term savings for their children. Junior ISAs offer tax-free savings for children under 18, with clear contribution limits and regulations.

Junior ISAs are part of a broader strategy for establishing a financial foundation for children, allowing families to save steadily over time. With careful planning, the funds in a Junior ISA can grow substantially by the time a child reaches adulthood, offering a useful financial head start.

This guide explains what a Junior ISA is, the current allowance, historical changes, and the differences between Junior ISAs and Child Trust Funds. It also explores what happens if contributions exceed the limit, how to open a Junior ISA, and provides guidance on managing it effectively.

What is the Junior ISA allowance and how does it work?

The Junior ISA (JISA) allows parents or guardians to save or invest for their child’s future in a tax-efficient way. For the 2025/26 tax year, the Junior ISA allowance is £9,000 per child, which represents the maximum amount that can be contributed across all Junior ISA accounts in that year.

Is it separate from the Adult ISA allowance?

The Junior ISA allowance is entirely separate from the adult ISA limit. This means a parent or guardian can use their full £20,000 adult ISA allowance while also contributing up to £9,000 into their child’s Junior ISA in the same tax year.

Can I split a Junior ISA between cash and Stocks & Shares accounts?

Each child can hold one Junior Cash ISA and one Junior Stocks and Shares ISA. The £9,000 annual limit applies to the combined total of both accounts, but it can be split in any way you choose, for example, £5,000 in a Cash JISA and £4,000 in a Stocks and Shares JISA.

Note: A child cannot hold a Child Trust Fund (CTF) and a JISA at the same time. Any existing CTF must be transferred to a JISA if you want to continue saving under the JISA rules.

Who can pay in?

Although only someone with parental responsibility can open a Junior ISA, anyone can contribute, including grandparents, relatives, and family friends. All contributions count toward the same £9,000 annual limit, so careful tracking is needed to avoid exceeding the allowance.

Use it or lose it

The allowance operates on a tax-year basis and cannot be rolled over. If you don’t use the full allowance by 5 April, the unused portion is lost for that year. Setting up regular monthly contributions can help make full use of the allowance.

The money belongs to the child

Once money is paid in, it legally belongs to the child and cannot be withdrawn until they turn 18. When they reach 18, the Junior ISA automatically converts into an adult ISA, and any future contributions then fall under the adult ISA rules.

Tax-free growth

All returns within a Junior ISA, whether interest from a Cash ISA or investment growth from a Stocks and Shares ISA, are completely tax-free. This allows every penny invested to work harder towards the child’s financial future.

What happens if I exceed the Junior ISA allowance?

Exceeding the Junior ISA limit isn’t a common issue, but it can happen if multiple family members contribute without telling each other. If contributions go over the allowance:

- The excess amount is returned by the provider.

- Interest or investment growth on the excess may be subject to taxation.

- Repeated breaches of the rules can result in penalties by HMRC.

To avoid exceeding the limit, it is important to track contributions closely and consider using tools such as a spreadsheet. Communication between family members means that the maximum allowance is not breached.

Junior ISA Rules

The main rules governing Junior ISAs include:

- Only one Junior ISA account of each type (cash and stocks and shares) can be held per child.

- The child becomes the account holder at 18, gaining full control of the funds.

- Funds cannot be withdrawn early, except in exceptional circumstances, such as terminal illness.

- Contributions from multiple parties are allowed, but the annual limit must not be exceeded.

- Accounts must be held with HMRC-approved providers.

- Transfers between Junior ISA providers* are permitted, allowing families to choose accounts with better rates or investment options.

Having a good understanding of the rules around Junior ISAs can help parents and guardians manage contributions responsibly and ensure that the child benefits fully from the tax-free savings.

*The new provider will need to coordinate the transfer to ensure its seamless and does not affect the annual allowance.

When does the Junior ISA allowance get renewed?

The Junior ISA (JISA) allowance is renewed each tax year. The allowance follows the UK tax year, which runs from 6 April to 5 April the following year. Contributions made within this period count toward that year’s allowance.

To make the most of the allowance, families can set up regular monthly contributions, helping to gradually reach the full limit without requiring a large lump sum.

The current Junior ISA allowance has remained at £9,000 per child since 2020, when it was increased from £4,368.

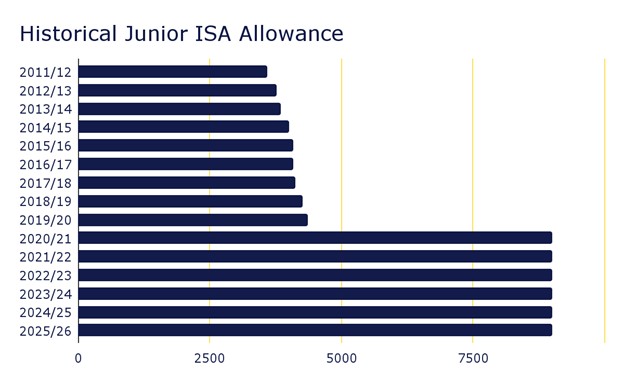

Historical Junior ISA Allowances

Tracking historical Junior ISA limits shows how government policy has encouraged saving for children:

Source: GOV.UK

This historical perspective can help families understand changes in savings potential over time and highlight the importance of staying up to date with current limits.

Helping your Child’s future grow with a Junior ISA

Junior ISAs provide a flexible, tax-free method of saving for a child’s future. With careful management, a Junior ISA can provide a substantial financial foundation for a child, supporting education, housing, or other needs when they reach adulthood.

Opening a Junior ISA* with Unity Mutual is straightforward. You’ll need to complete a short application form, supply us with the child’s personal details (name, date of birth, address), and make an initial contribution.

Many providers let you set up regular contributions through Direct Debits, which helps you gradually reach the annual allowance.

*Terms and conditions apply (capital at risk).

Need help?

Email us

Send us an email at insure@unitymutual.co.uk

Customer centre

Take a look at our customer centre